kentucky property tax calculator

Property tax is calculated based on your home value and the property tax rate. The average effective property tax rate in Kentucky is 083.

5 Common Reasons Why Property Taxes Go Up No Matter Where You Live Estate Tax Property Tax Property Marketing

Sales taxes in the United States Wikipedia Jefferson County KY Property Tax Calculator SmartAsset Kentucky Property Tax Calculator SmartAsset States Moving Away From Taxes on Tangible Personal Property Tax Foundation How do state and local property taxes work.

. The annual appreciation is an optional field where you can enter 0 if you do not wish to include it in the KY property tax calculator. All property that is not vacant is subject to a 911 service fee of 75 for each dwelling or unit on the property. For most counties and cities in the Bluegrass State this is a percentage of taxpayers.

Ad Download Property Records from the Kentucky Assessors Records. This calculator can only provide you with a rough estimate of your tax liabilities based on the property. Aside from state and federal taxes many Kentucky residents are subject to local taxes which are called occupational taxes.

Property taxes in kentucky are relatively low. Kentucky has one of the lowest median property tax rates in the United States with only seven states collecting a lower median property tax than Kentucky. Kentucky homeowners pay 1257 annually in property taxes on average.

Kentucky imposes a flat income tax of 5. It is based ONLY upon the taxes regarding inventory. Kentucky has a flat income tax rate of 5 a statewide sales tax of 6 and property taxes that average 1257 annually.

Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another. On average homeowners pay just a 083 effective property tax. The tax rate is the same no matter what filing status you use.

Both the sales and property taxes are below the national averages while the state income tax is right around the US. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase. Most Kentucky property tax bills do not separately itemize the tax on inventory from taxes on other categories of tangible property.

Please note that this is an estimated amount. Based on a 200000 mortgage. 121 rows The states average effective property tax rate annual tax payments as a percentage of home value is also low at 083.

Counties in Kentucky collect an average of 072 of a propertys assesed fair market value as property tax per year. All rates are per 100. Of course where you choose to live in Kentucky has an impact on your taxes.

Actual amounts are subject to change based on tax rate changes. The median property tax on a 15920000 house is 167160 in the United States. Campbell County has the highest average effective rate in the state at 117 while Carter County has the lowest rate at a mere 051.

Payment shall be made to the motor vehicle owners County Clerk. Our Allen County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Kentucky and across the entire United States. Payment should be made to the County.

Use our sales tax calculator or download a free kentucky sales tax rate table by zip code. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase. 0930 of Assessed Home Value.

When ownership in Kentucky is transferred an excise tax of 50 for each 500 of value or fraction thereof is levied on the value of the property. Our Kentucky Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Kentucky and across the entire United States. In an effort to assist property owners understand the administration of the property tax in Kentucky this website will provide you with information that explains the various components of the property tax system.

How Your Property Taxes Compare Based on an Assessed Home Value of 250000. Grayson County collects on average 052 of a propertys assessed fair market value as property tax. This rate is set annually by July 1 and it applies to all real property tax bills throughout Kentucky.

Kentucky Property Tax Calculator to calculate the property tax for your home or investment asset. The median property tax in Kentucky is 84300 per year for a home worth the median value of 11780000. KRS 1322201aThe person who owns a motor vehicle on January 1 st of the year is responsible for paying the property taxes for that vehicle for the year.

What is the Kentucky homestead exemption. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Fayette County. The median property tax on a 13190000 house is 138495 in the United States.

For example the sale of a 200000 home would require a 200 transfer tax to be paid. Therefore the DOR Inventory Tax Credit Calculator is the. The median property tax on a 13190000 house is 84416 in Hardin County.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Kentucky local counties cities and special taxation districts. Deduct the amount of tax paid from the tax calculation to provide an illustration of your 20212022 tax refund. The median property tax on a 13190000 house is 94968 in Kentucky.

Tax Policy Center New tax in Kentucky could send boaters to Indiana side News. Property Valuation Administrators PVAs in each county must list value and assess the property tax on motor vehicles and motor boats as of January 1 st of each year. Thats partly because of low home values in the state the median home value is 151700 but also because of low rates.

The median property tax on a 15920000 house is 114624 in Kentucky. The median property tax on a 10200000 house is 107100 in the United States. Overview of Kentucky Taxes.

1070 of Assessed Home Value. It is levied at six percent and shall be paid on every motor vehicle used in. Grayson County has one of the lowest median property tax rates in the country with only two thousand five hundred forty two of the 3143 counties.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Owen County. Keep in mind a deed cannot be recorded unless the real estate transfer tax has been collected. Todays Best 30 Year Fixed Mortgage Rates.

How high are property taxes in Kentucky. The tax estimator above only includes a single 75 service fee. Over the years the State real property tax rate has declined from 315 cents per 100 of assessed valuation to 122 cents due to this statutory provision.

The median property tax on a 10200000 house is 73440 in Kentucky. Motor Vehicle Property Tax Motor Vehicle Property Tax is an annual tax assessed on motor vehicles and motor boats. The median property tax in Grayson County Kentucky is 434 per year for a home worth the median value of 83700.

Local Property Tax Rates. Explanation of the Property Tax Process. See Results in Minutes.

Look Up Any Address in Kentucky for a Records Report. 0830 of Assessed Home Value.

Jefferson County Ky Property Tax Calculator Smartasset

Best Places To Retire To Make Your Retirement Income Go Farther Seeking Alpha Income Tax Retirement Income Tax Forms

Kentucky Property Tax Calculator Smartasset

The Best States For An Early Retirement Early Retirement Health Insurance Life Insurance Facts

How To Calculate Debt To Income Ratio For Home Loan Google Search Debt To Income Ratio Mortgage Marketing Mortgage Approval

States With The Highest And Lowest Property Taxes Property Tax High Low States

6936 Mockingbird Trail Real Estate House Styles Property

Harris County Appraisal District How Property Is Appraised Property Tax Appraisal Appraised Property Hcad Property Ta Appraisal Harris County Property Tax

State By State Guide To Taxes On Retirees Retirement Advice Retirement Locations Retirement

An Introduction To Rural Housing Development Guaranteed Rural Housing Program Mortgage Amortization Calculator Mortgage Loan Calculator Mortgage Amortization

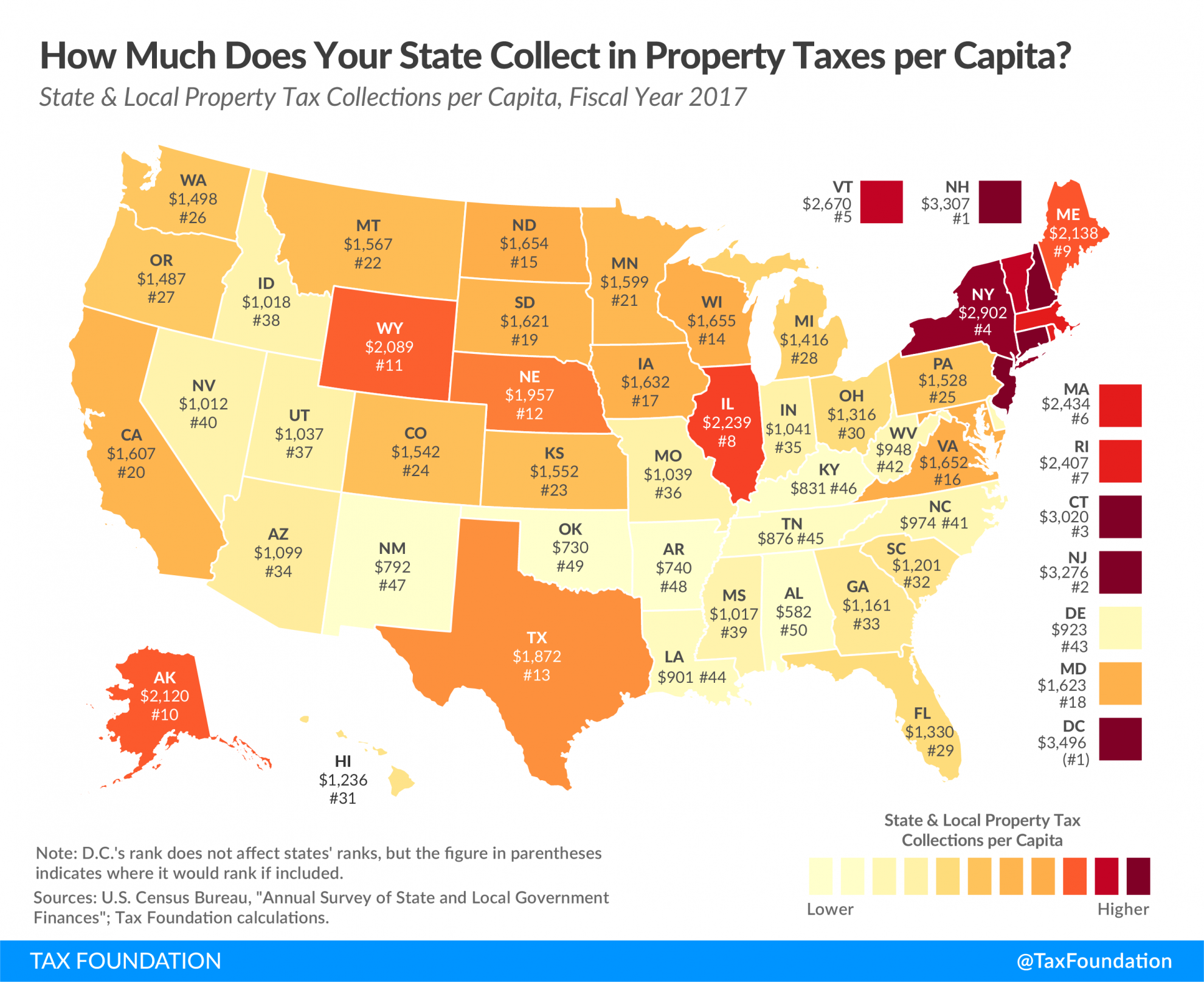

Monday Map State Local Property Tax Collections Per Capita Teaching Government Property Tax Map

100 Financing Zero Down Payment Financing Kentucky Mortgages Home Loans For Ky Mortgage Mortgage Loans Mortgage Tips

Pin By Kirunda Group Corp On Real Estate Investing Being A Landlord Real Estate Investing Property Tax

The 10 Most Tax Friendly States For Retirees Green States As Of 2019 Retirement Tax Income Tax

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States

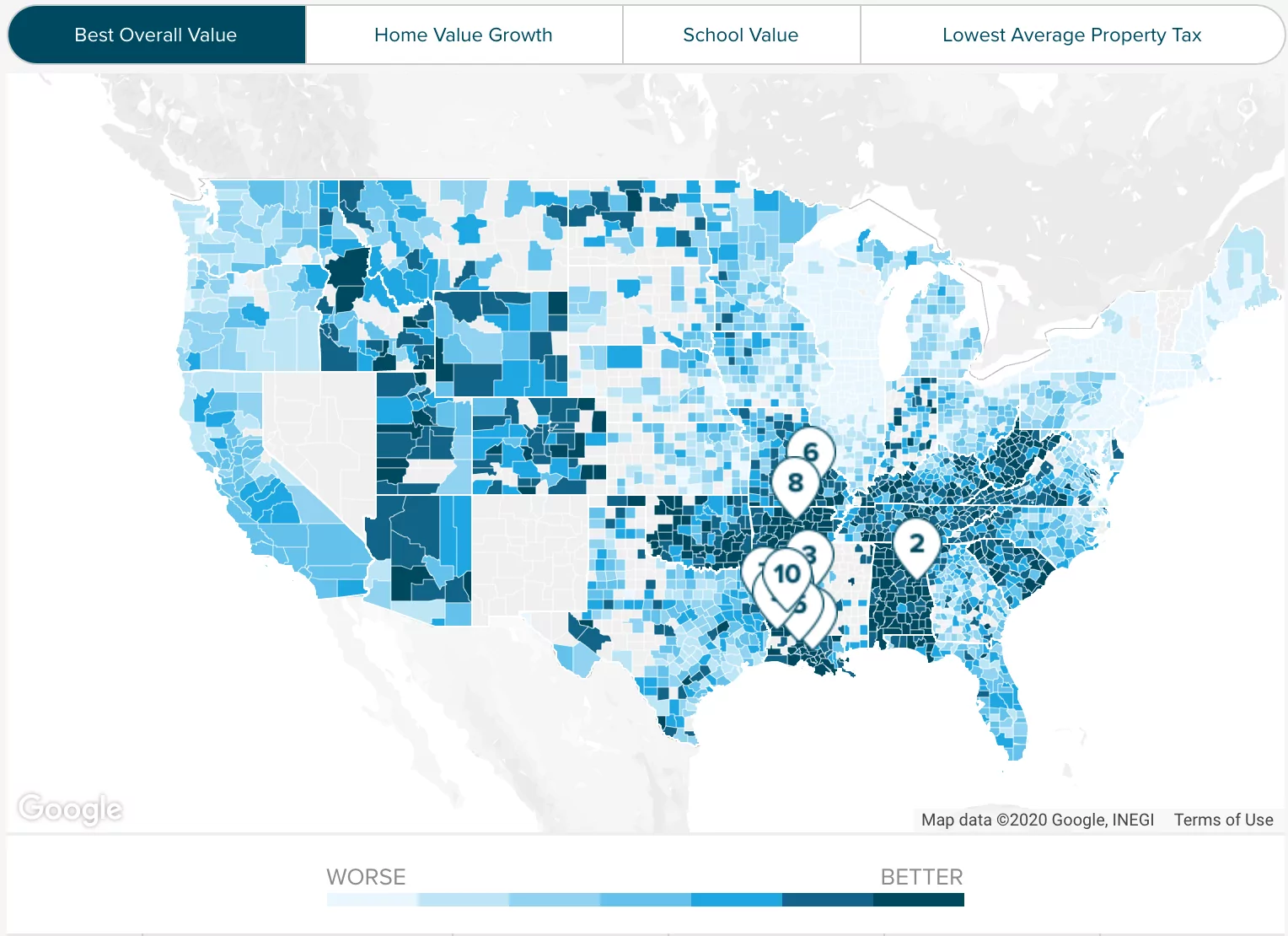

Property Tax Rate In Illinois Close To Nation S Highest City Boise City Sioux Falls